This month we’ve launched two exciting product updates in Lemax. Learn about the details below.

New Columns on Financial Report for Better Reporting VAT Corrections

What’s new

- Financial reports and Reservation report have been updated so that the VAT columns are renamed to be consistent with the value represented. Also, all missing VAT columns were added to the report.

- It is now possible to have an overview of the VAT rate of the services on financial reports and Reservation report

- It is now possible to have an overview of the taxation schemes of the services on financial reports and Reservation report

Problem

VAT in tourism can be calculated in different ways. The problem we are solving concerns clients that calculate VAT as a percentage of the margin.

Margin is calculated as a difference between selling and net price. It is called a predefined margin. VAT is then calculated and paid based on the predefined margin.

Later on, the actual invoiced selling price (Invoiced amount) and invoiced net price by the supplier (Invoiced by supplier) may differ from the predefined ones. That will also change the actual margin (Invoiced margin), and consequentially the final VAT that needs to be paid. Also, the difference between commercial and accounting exchange rates could be the reason for value discrepancies, that impact the final VAT that needs to be paid.

To be able to reconcile the paid and final VAT, the user needs an overview of such bookings, with VAT values.

Benefit for the users

The user is able to have an overview of:

- exact VAT values (predefined, invoiced, approximated, net, selling)

- VAT rates per service, that enables actioning the correct bookings and services

- VAT taxation scheme, that enables actioning the correct bookings and services

How it works

All changes are done on Financial reports and Reservation report.

Selling VAT:

Column “VAT” is renamed to “Selling VAT”

Approximated net VAT:

Column “Net VAT” is renamed to “Approximated net VAT”

Predefined net VAT:

“Predefined net VAT” column is added and represents the difference between “Predefined net price” and “Predefined net price (no VAT)”

Invoiced VAT:

“Invoiced VAT” column is added and represents the difference between “Invoiced amount” and “Invoiced amount (no VAT)”

VAT rate:

VAT rate columns:

VAT rate column is added to the reports. It represents the rate defined on service level

If both Input and Output VAT are used, both columns are visible on the reports

VAT rate filters:

VAT rate filter is added to the Financial reports

If both Input and Output VAT are used, it is possible to filter services by both values of VAT rate

Taxation scheme

The functionality depends on the client setup and business needs.

Taxation scheme columns:

Taxation scheme column is added to the reports. It represents the way of calculating VAT per service, and is defined on service level

If both Input and Output VAT are used, both Input and Output taxation scheme columns are visible on the reports

Taxation scheme columns:

Taxation scheme filter is added to the financial reports

If both Input and Output VAT are used, it is possible to filter services by both values of taxation scheme

New Filter by Payment Method in Invoices and Advance Payment Invoices Grid

What’s new

In an effort to improve user experience in using Lemax, additional filtering has been added to documents grid.

Problem

In certain business scenarios, the payment method is a mandatory parameter used for creating invoices and advance payment invoices. Users were not able to filter those documents by its payment method.

Benefit for the users

- improved filtering for better management and overview of invoices and advance payment invoices

- improved user experience

How it works

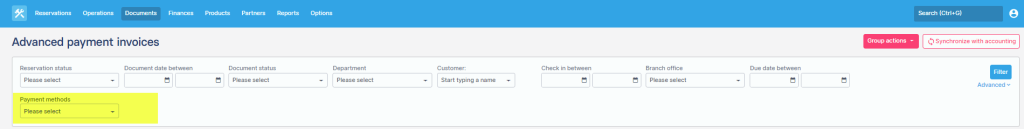

Advance payment invoices grid

In the Filter section, a new filter per payment method has been added:

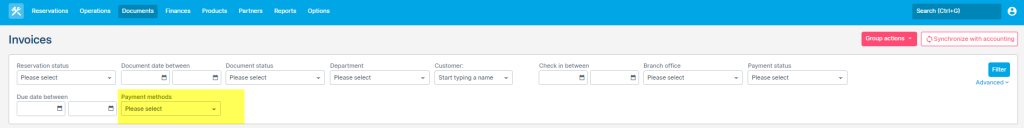

Invoices grid

In the Filter section, a new filter per payment method has been added: